How to Set Up a Budget for Irregular Income

Living with unpredictable pay can feel like a financial roller coaster. One month you’re ahead, the next you’re struggling to cover your essential monthly bills. If you’re a freelancer, gig worker, or seasonal earner, creating a budget with irregular income isn’t just helpful—it’s necessary. Traditional budgeting doesn’t always fit when your paychecks aren’t steady.

That’s why smart fluctuating income budgeting is key to keeping control. With the right plan, you can manage extra earnings, prepare for low-income month strategies, and stop the stress of paycheck-to-paycheck living. This guide will show you how to build a flexible, realistic, and strong financial cushion for any month.

What Is Irregular Income and Who Does It Affect?

Irregular income is money that doesn’t come in on a steady schedule or in fixed amounts. Unlike salaried workers who receive a fixed monthly salary, gig workers, commission earners, and freelancers may experience periods of high earnings followed by low ones. That’s why budgeting when income is unpredictable requires more effort.

This type of income affects many in the United States. Budgeting for gig workers, seasonal income planning, and budgeting for small business owners is a must. They face issues like late payments, unpaid time off, and irregular job opportunities. If you don’t plan ahead, even a small setback can hurt.

Why Budgeting with Irregular Income Is Even More Important

Traditional budgets don’t always work when your income changes month-to-month. You can’t rely on a fixed paycheck, so copying a monthly budget from someone with a salary just won’t cut it. You must develop a flexible, custom plan for your unique roller coaster income pattern.

Without budgeting, it’s easy to overspend when you earn more and fall behind in low months. You might delay monthly financial commitments or even rack up debt. With the right plan, though, you can smooth the ride. It all starts with financial planning for freelancers and learning to build a financial cushion for bad months.

How to Stop Living Paycheck to Paycheck with Irregular Income

Many people with fluctuating income budgeting problems live paycheck to paycheck. To stop this cycle, you need to change your mindset. Stop treating high-income months as the new normal. Instead, use those times to save and create a savings buffer.

A smart move is to plan like your worst month is the usual one. Then, everything extra is a bonus to save or invest. This makes your budget strong and stable. Budgeting during high-income months helps reduce stress in the lean times.

Step 1 – Track and Calculate Your Average Income

Start by looking back at your last 3 to 6 months. Add up all the money you made and divide it by the number of months. This gives you your average monthly income. Or, use your lowest month as your baseline monthly income. That gives you a conservative number to plan with.

You must always calculate based on net monthly earnings, not gross. That means what’s left after estimated taxes. It’s your real take-home pay. Here’s a simple table:

| Month | Gross Income | Taxes | Net Monthly Earnings |

|---|---|---|---|

| January | $5,000 | $800 | $4,200 |

| February | $4,500 | $700 | $3,800 |

| March | $3,200 | $600 | $2,600 |

| Average | — | — | $3,533 |

You can use apps like Mint, YNAB, or QuickBooks to track income and expenses. These tools make budgeting steps for gig economy workers easier and more accurate.

How Do I Manage Inconsistent Payments?

Use your monthly averages to make predictions. This keeps your budget realistic. You should also build up a buffer fund for freelancers during high months. This will cover shortfalls when things slow down.

Don’t rely on luck. Use facts and your past income data to control your spending. Budgeting is not just math—it’s planning for your future.

Step 2 – Identify and Prioritize Your Essential Expenses

Make a list of your essential monthly bills. These include housing, food, health insurance, debt payments, and transport. These are your must-pays no matter what. Then list the extras like subscriptions, dining out, or entertainment.

Knowing the difference between personal “wants” and “needs” helps you decide what can be delayed or skipped. Fixed expenses come first, always. The rest depends on your income that month.

What If My Income Is Too Low This Month?

This is where your low-income month strategies come in. If your earnings are down, cover rent and food first. Delay the gym, cancel streaming, or cook instead of eating out.

You may even qualify for community support during tough times. But a better plan is to always be ready. That means extra earnings management during the good months.

Step 3 – Separate Flexible and Non-Essential Spending

Now that your core needs are covered, look at the rest. Flexible income budgeting means knowing when to enjoy life and when to hold back. List all the extras you spend money on: takeout, online shopping, gadgets.

Then group them by priority. This will help you avoid nonessential expenses when times are tight. A simple mindset shift can turn a spending problem into a saving habit.

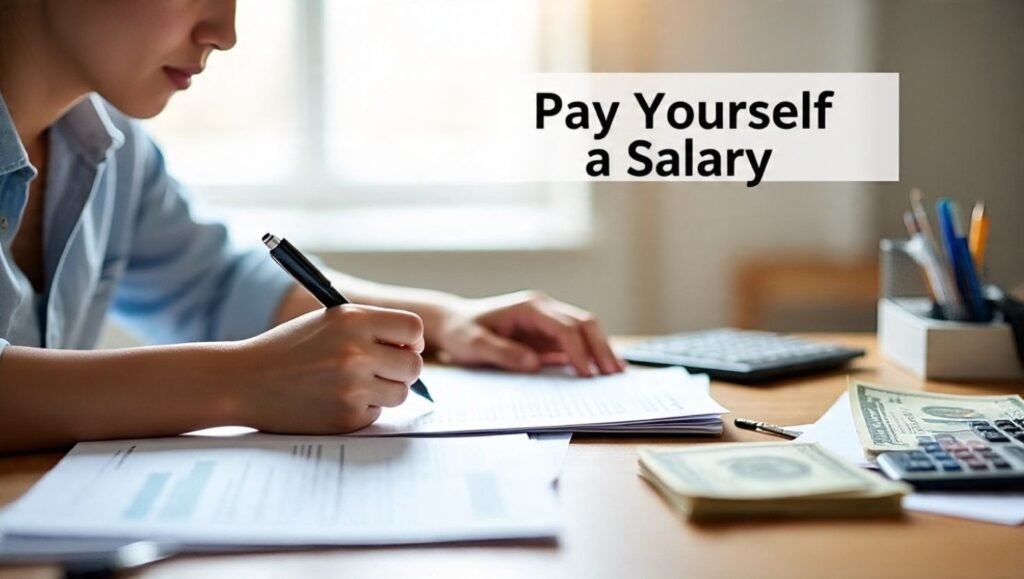

Step 4 – Use a Zero-Sum or “Pay Yourself a Salary” Budget

The zero-based budgeting method means every dollar gets a job. If you earn $4,000 in a month, you should assign all of it—some for rent, some for savings, some for groceries. Nothing should just sit unused.

A smart self-employed income strategy is to pay yourself a salary. Use your average income to create a steady amount you “pay” yourself every month. If you make more, stash the extra in savings. This makes your income feel consistent even when it’s not.

Step 5 – Build a Buffer and Emergency Fund

Every freelancer needs a savings account for low months. Your buffer fund for freelancers can keep you afloat when no checks are coming in. Save at least 1 to 3 months of expenses.

This is not the same as your emergency fund, which is for unexpected costs like car repair or a medical bill. Both funds are important. Start small and grow your safety net with discipline.

Best Savings Strategies for Gig Workers

Open separate accounts for savings. Use auto transfers during high-income times. Even $50 a week adds up. Avoid lifestyle creep—that’s when you spend more just because you earned more.

Stay focused on your goals. Use part of every payment to grow your buffer. This makes your future stronger and more stress-free.

Step 6 – Separate Accounts for Spending, Saving, and Bills

It’s smart to use different bank accounts for different needs. Have one account for bills, one for everyday spending, and one just for savings. This setup supports better cash flow control.

You’ll be less tempted to spend your rent money on a shopping spree. Also, make sure to save for taxes and retirement. These don’t go away just because your income is flexible.

Step 7 – Monitor and Adjust Your Budget Regularly

Even the best budgets need updates. Monitor your spending every month. Look for money leaks—those small purchases that add up without you realizing.

Every few months, check your income patterns. Did you make more than expected? Great—add to savings. Less than expected? Time to tighten up. Make budgeting a habit, not a chore.

Step 8 – Use Professional Tools and Resources for Support

There’s no shame in needing help. Apps like YNAB (You Need A Budget), PocketGuard, and Mint can help you track every dollar. Some banks and credit unions offer free financial coaching.

Also check out free tools from CFPB and local Extension offices. These services often have worksheets and training for budgeting for gig workers. Take advantage of them.

Budgeting with a variable income doesn’t have to be scary. It just takes planning, consistency, and a few smart habits. Use this guide to set up your irregular income budget, build your safety net, and stay ahead of your bills—no matter what your paycheck looks like this month.

If you found this guide useful, share it with a fellow freelancer or gig worker who needs help managing money with inconsistent income. Let’s build financial freedom together.

FAQ:

Conclusion: Mastering Your Budget with Irregular Income

Creating a budget with irregular income may seem hard at first, but with the right plan, it becomes much easier. Whether you’re a freelancer, gig worker, or small business owner, building a flexible income budgeting system gives you control, not chaos. Start by tracking your net monthly earnings, plan for your essential monthly bills, and prepare for both low and high months with smart seasonal income planning. Over time, using tools like the pay yourself a salary method and building a solid savings account for lean months will help you break the paycheck-to-paycheck cycle. Remember, budgeting is not about restriction—it’s about building a financial cushion and gaining peace of mind, no matter how unpredictable your income is.